Introduction

Forex trading relies heavily on data analysis, strategic planning, and precise execution. One of the most critical tools for traders is Forex Signals Analysis, a process that involves evaluating trade signals to determine the best opportunities for profit. By understanding and interpreting these signals effectively, traders can make informed decisions, minimize risks, and improve their trading success.

This comprehensive guide will delve into what Forex signals analysis entails, the methods used, and actionable strategies for leveraging it to enhance your trading performance. For premium signal services that simplify your trading journey, explore our Pricing Plans.

What Is Forex Signals Analysis?

Forex signals analysis involves examining trade signals, which are recommendations provided by experts or automated systems, to identify potential trading opportunities. These signals typically include:

- Entry Points: Price levels to open a trade.

- Exit Points: Price levels to close the trade for profit or loss.

- Stop-Loss and Take-Profit Levels: Risk management tools to protect your capital.

- Market Insights: Supporting data or analysis to justify the trade recommendation.

Forex signals analysis allows traders to validate these recommendations using their own tools, strategies, and market insights.

Why Is Forex Signals Analysis Important?

Effective signals analysis provides numerous benefits to traders, including:

- Improved Accuracy

- By validating signals, traders can reduce the risk of false entries.

- Risk Management

- Analysis helps set appropriate stop-loss and take-profit levels to minimize potential losses.

- Enhanced Decision-Making

- Signals analysis provides a deeper understanding of market behavior, enabling informed decisions.

- Increased Profitability

- Analyzing signals allows traders to select the most lucrative opportunities while avoiding risky trades.

Methods for Analyzing Forex Signals

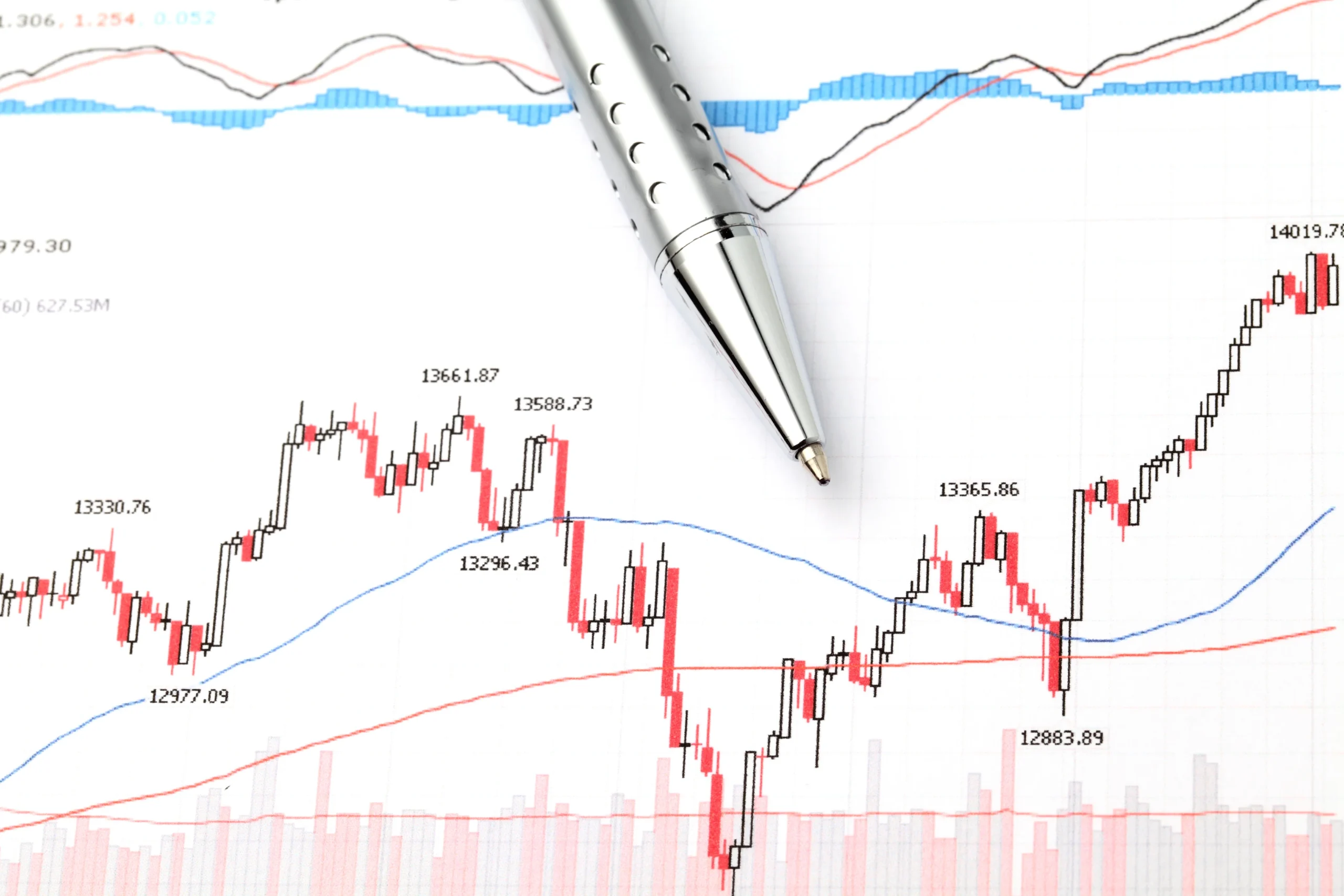

- Technical Analysis

Technical analysis involves studying price charts and applying indicators to evaluate signals.

Common Tools Used:

- Moving Averages (MA): Identify trends by smoothing price data.

- Relative Strength Index (RSI): Determine overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Measure momentum and trend direction.

- Bollinger Bands: Assess market volatility and potential breakout points.

How to Use:

- Compare the signal’s suggested entry point with key support or resistance levels.

- Validate the trend using moving averages or MACD.

- Fundamental Analysis

Fundamental analysis evaluates economic, political, and financial factors that influence currency prices.

Key Factors to Monitor:

- Interest rates and central bank policies.

- Employment reports and GDP growth.

- Geopolitical events and trade agreements.

How to Use:

- Align signals with upcoming economic events to confirm their relevance.

- Avoid trades that may be disrupted by high-impact news.

- Sentiment Analysis

Sentiment analysis assesses market psychology to understand whether traders are bullish or bearish on a currency pair.

Tools for Sentiment Analysis:

- Commitment of Traders (COT) Report: Provides insights into institutional trading positions.

- News Sentiment: Gauges market reactions to news headlines.

How to Use:

- Use sentiment analysis to confirm whether the signal aligns with broader market sentiment.

- Volume Analysis

Volume analysis measures the number of trades executed during a specific period, providing insights into market participation.

Indicators for Volume Analysis:

- On-Balance Volume (OBV): Tracks cumulative buying and selling pressure.

- Volume Oscillator: Compares short-term and long-term volume averages.

How to Use:

- High volume during a breakout confirms the validity of the signal.

Steps for Analyzing Forex Signals

Step 1: Understand the Signal Components

Familiarize yourself with the key elements of the signal, including:

- Entry and exit points.

- Stop-loss and take-profit recommendations.

- Supporting analysis or reasoning.

Step 2: Validate the Signal with Your Strategy

- Compare the signal with your preferred indicators or analysis methods.

- Ensure it aligns with your risk tolerance and trading goals.

Step 3: Monitor Market Context

- Check for upcoming news or events that could impact the signal’s performance.

- Adjust your strategy accordingly.

Step 4: Execute the Trade

- Place the trade if the signal meets your criteria.

- Use the recommended stop-loss and take-profit levels for risk management.

Step 5: Review Performance

- Analyze the trade’s outcome to refine your strategy and improve future results.

Common Indicators Used in Signals Analysis

- Moving Averages (MA)

- Identify trends and support or resistance levels.

- RSI (Relative Strength Index)

- Measure momentum to confirm the strength of a trend.

- MACD (Moving Average Convergence Divergence)

- Analyze momentum shifts and potential reversals.

- Fibonacci Retracement

- Identify support and resistance levels during price pullbacks.

- Bollinger Bands

- Detect breakout points and assess market volatility.

Strategies for Better Trading Decisions with Signals Analysis

- Combine Technical and Fundamental Analysis

- Use technical tools to validate signals while considering fundamental factors for broader context.

- Focus on High-Probability Trades

- Prioritize signals that align with market trends and high-volume currency pairs.

- Practice Risk Management

- Always set stop-loss orders and limit your position size to minimize potential losses.

- Use Multi-Timeframe Analysis

- Validate signals by analyzing them across different timeframes for consistency.

- Avoid Overtrading

- Stick to high-quality signals and avoid executing trades impulsively.

Advantages of Forex Signals Analysis

- Increased Confidence

- Validating signals builds trust in your trading decisions.

- Improved Profitability

- Focused analysis helps identify high-quality trade opportunities.

- Better Risk Management

- Signals analysis ensures stop-loss levels are appropriately set.

- Enhanced Learning Opportunities

- Analyzing signals helps traders understand market behavior better.

Common Mistakes to Avoid in Signals Analysis

- Blindly Following Signals

- Always validate signals with your analysis instead of relying on them entirely.

- Ignoring Market Context

- Consider broader economic and geopolitical factors that may impact the signal’s accuracy.

- Overcomplicating Analysis

- Avoid using too many indicators, which can lead to conflicting signals.

- Neglecting Risk Management

- Always use stop-loss levels to protect your capital.

Choosing the Right Signal Provider

Qualities to Look For:

- Accuracy and Transparency

- Providers should have a proven track record and explain their methodology.

- Real-Time Delivery

- Signals should be delivered promptly for timely execution.

- Customizable Features

- Tailored signals based on trading styles or preferences are ideal.

Explore our Pricing Plans to access premium signals designed for success.

Building a Long-Term Strategy with Signals Analysis

- Set Clear Goals

- Define profit targets and risk tolerance levels.

- Reinvest Profits

- Use earnings to gradually increase your trading capital.

- Diversify Trades

- Trade multiple currency pairs to spread risk.

- Evaluate Performance

- Regularly assess your trading results to refine your strategy.

Conclusion

Forex Signals Analysis is a critical skill for traders looking to enhance their trading performance. By combining technical, fundamental, sentiment, and volume analysis, traders can validate signals, make informed decisions, and achieve consistent success.

To maximize the potential of Forex signals, choose reliable providers, practice disciplined risk management, and continuously refine your strategies. For tools that simplify your trading journey, visit our Forex Calculators or Sign up for an XM Global account to access premium signal services. With the right approach, analyzing Forex signals can become the cornerstone of your trading success.